When it comes to investing, the Fort Dodge Community Foundation has one primary goal: providing steady growth in a conservative manner in order to maximize your philanthropy, both today and for years to come.

The Foundation’s investment portfolio is managed professionally with the long-term objectives of safeguarding principal, increasing that principal’s growth sufficiently to offset any decrease in purchasing power due to inflation and generating income for distribution to support the charitable interests of our donors. The Foundation cannot guarantee a particular investment result, either as to income or as to principal appreciation, but our professional fund managers will strive to achieve the highest total return possible commensurate with appropriate risk and prudent investment strategies.

We take great care to ensure that all funds that we manage are professionally invested, and are done so wisely, transparently and prudently. We strive to invest our funds so they will grow over time and be available for grant-making today and for many years to come.

We are committed to preserving and maximizing your gift for future generations. Our investment strategy aims to safeguard your principal while achieving high returns with a diverse and balanced portfolio. By researching and hiring investment managers with a record of outperforming our benchmarks, we are able to closely monitor their performance to ensure they are meeting our needs and expectations. If we feel an investment manager is not meeting our requirements, our Board of Directors will make a change to another manager to direct our investments to meet and exceed our standards.

The Community Foundation’s fixed income investments (bonds rated by Moody’s or S&P investment grade, and cash equivalents) provide a deflation hedge, reduce volatility and produce current income in support of the foundation's administrative expenses and grant payouts. The community foundation’s goal is to perform at or near the Barclays Aggregate Bond Index. Performance is monitored on a quarterly basis and is evaluated over three- and five-year rolling periods.

The Community Foundation’s equity investments provide long-term capital growth through investments in securities, common stock and, to a smaller extent, foreign equities. The Community Foundation seeks to outperform the S&P 500 stock index over a full market cycle. The equity investments are compared to the Mobius Universe equity manager means. Performance is monitored on a quarterly basis and is evaluated over three- and five-year rolling periods. The equity portion of the fund strives to exceed the Consumer Price Index plus 6 percent over three-year rolling periods.

The Fort Dodge Community Foundation may invest a small percentage of funds in alternatives. Alternative investments are not one of the three traditional asset types (stocks, bonds and cash). Most alternative investment assets include real estate investment trusts (REITS), commodities, managed futures and hedge funds. Alternative investments are favored mainly because their returns have a low correlation with those of standard asset classes and they can serve as an effective strategy to enhance the diversification of an investment portfolio.

Asset allocation is an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according to our risk tolerance, goals and investment time frame. Asset allocation divides our investment portfolio across various asset classes like stocks, bonds and money market securities.

Allocating our investments among different asset classes is a key strategy to help minimize risk and potentially increase gains. Consider it the opposite of "putting all your eggs in one basket." Essentially, asset allocation is an organized and effective method of diversification.

Asset allocation is based on the principle that different assets perform differently in different market and economic conditions. Asset allocation is based on the premise that different asset classes offer returns that are not perfectly correlated, hence diversification reduces the overall risk in terms of the variability of returns for a given level of expected return.

Our investment manager determines the asset allocation strategy based on market conditions and factors impacting economic circumstances and opportunities.

Our options typically fall within three classes - stocks, bonds, cash and alternatives. Within these classes are subclasses (the variations within each category). Some subclasses and alternatives include:

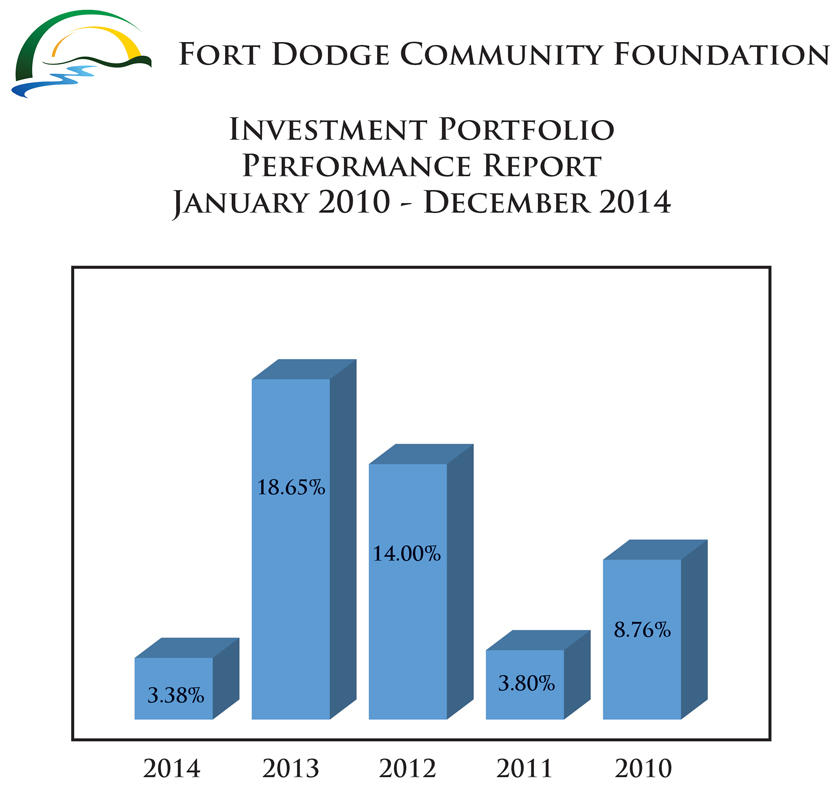

In July 2011, the Investment Portfolio funds were reinvested utilizing an enhanced investment strategy that uses an open architecture approach that offers the flexibility to use mutual funds and separate account managers for each asset class. We now have access to some of the best fund managers in the nation that manage designated portions of the portfolio with a stated investment process, strategy and guidelines. Since inception, our Investment Portfolio has averaged 11.48%.

Generally, investment managers use the performance of an index or average that tracks representative stocks or bonds as a means to measure investment performance. The index serves as an indicator of the overall direction of the market as a whole, or of particular market segments. Investors use these indexes and averages as benchmarks, to see how particular investments or combinations of investments measure up.

The Fort Dodge Community Foundation measures its investment performance against the three benchmarks, Standard & Poors 500 Stock Index, Barclays Aggregate Bond Index, and MSCI EAFE Net Index. These benchmarks allow us to more accurately measure the performance of our investments as prescribed in the Foundation’s investment policy.

The Fort Dodge Community Foundation has retained the investment management services of First American Wealth Management, which is affiliated with First American Bank. First American Bank was chartered in Fort Dodge, Iowa, in 1934, and served the needs of the community for some 65 years before embarking on considerable growth to serve many other Iowa communities statewide. Since 1968, First American Bank has provided Private Wealth Management services to a variety of individuals and organizations. As of 12/31/2013, First American Wealth Management had $662,880,186 under management, representing approximately 350 relationships comprised of 1,102 accounts. First American Wealth Management currently works with 26 charitable organizations in the state of Iowa, representing $99,000,000 in total assets.

Like many of our fund-holders, you may have a longstanding relationship with a trusted investment manager. We value that relationship and can work with you to allow your advisor to continue managing your charitable fund at the Fort Dodge Community Foundation.

For more information about investments and maximizing your gift, contact Randy Kuhlman, CEO, at 515.573.3171 or rk@fd-foundation.org.